Mandalay Bay Casino Stock

- Mandalay Bay Casino Host Directory

- Mandalay Bay Casino Hosts

- Mandalay Bay Casino Shooting

- Mandalay Bay Casino Stock

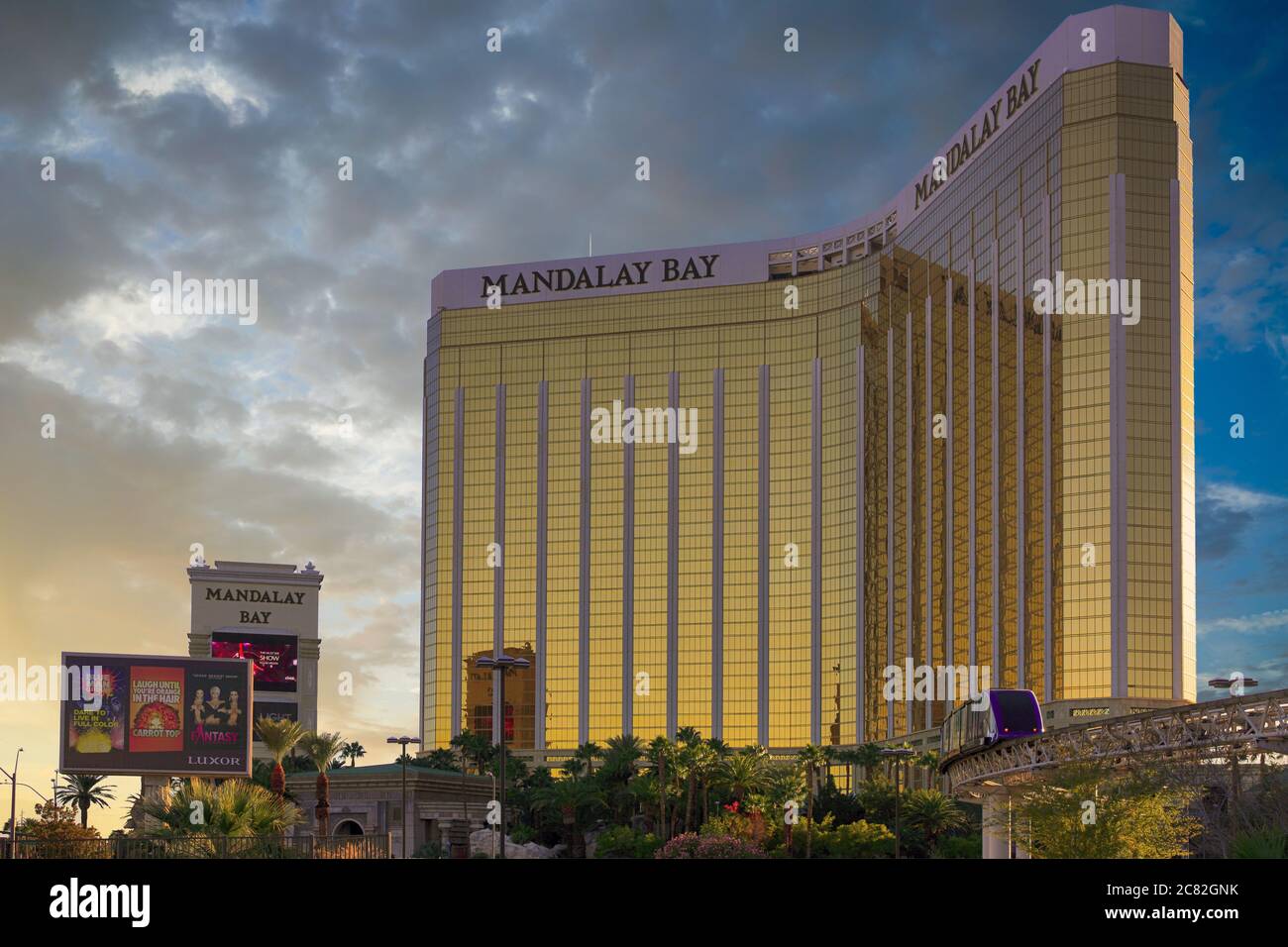

Shares for Las Vegas casino Mandalay Bay’s parent company MGM Resorts International have fallen 5 percent the day after Stephen Paddock shot and killed at least 58 people from his hotel room. Shares of casino operators fell on Monday after the Las Vegas massacre, the deadliest shooting in U.S. MGM Resorts International, which owns the Mandalay Bay hotel near where the shooting.

- Its major properties included Mandalay Bay, Luxor, Excalibur and Circus Circus, as well as half of the Monte Carlo. In terms of market capitalization, it was one of the largest casino operators in the world. Its stock traded on the New York Stock Exchange with the ticker symbol 'CIR' and 'MBG'.

- The Mandalay Bay is one of 13 properties owned by MGM Growth according to a filing. The MGM Grand, one of few properties still owned by MGM Resorts, is expected to be sold by the end of the year.

- Find professional Mandalay Bay Resort And Casino videos and stock footage available for license in film, television, advertising and corporate uses. Getty Images offers exclusive rights-ready and premium royalty-free analog, HD, and 4K video of the highest quality.

In the brief period that the stock market has been open in the wake of the Las Vegas terrorist attack, the price of shares for American Outdoor Brands (AOBC) — formerly Smith & Wesson — grew by 4 percent while Sturm Ruger (RGR) were up 3 percent.

According to CNBC, the rise in share prices has become the unfortunate norm following tragedy as investors often speculate that massacres would lead to stricter gun laws and thusly push more buyers into the market.

The latest, and most damaging attack, happened during the Route 91 Harvest Festival in Las Vegas on Sunday night as Stephen Paddock opened nine seconds of non-stop automatic gunfire from the 32nd flood of Mandalay Bay Resort and Casino in the first round of shooting, followed by two shorter rounds.

The 2016 Pulse Nightclub tragedy in Orlando (Florida); the San Bernadino (California) courthouse shooting in 2015; the Movie Theatre assault in Aurora (Colorado), as well as the Sandy Hook Elementary School in Newtown (Connecticut) in 2012 all saw stock increases for major gun manufacturers after the events.

This is one of the first times that stocks of the two brands have seen positive growth as the election results going to Republican candidate, and now President, Donald Trump, alleviated many fears from the public, which had expected more restrictions if Hillary Clinton had won the White House.

Sturm Ruger reported a drop of 22 percent in quarterly revenue in its release in August, and noted that earnings had dropped more than 50 percent.

American Outdoor Brands were similarly low in quarterly releases as it reported a 40 percent decrease in sales during the previous period.

0commentsThe dip in manufactures losses have been seen at sporting good stores as well, with Dick's Sports Goods (DKS) shares being down 50 percent this year.

Cabella's gun sales have also dipped and Gander Mountain was forced to shut down several stories and file for bankruptcy.

Las Vegas Sands looks like the better bet compared to MGM Resorts in our opinion. Our conclusion is based on our detailed dashboard analysis, Is Las Vegas Sands Expensive Or Cheap After A -26.4% Move vs. MGM Resorts International?wherein we compare trends in key metrics for the two casino companies over the years to determine their relative valuations under the current circumstances.

Mandalay Bay Casino Host Directory

Casino stocks have been trending downwards since the coronavirus outbreak was declared an epidemic in China, which subsequently led to a two-week shutdown in Macau. However, the containment efforts didn’t last long and the WHO declared COVID-19 a pandemic on March 11. The impact of coronavirus crisis and oil price war has been felt by nearly all sections of the global economy, resulting in a 20% decline in market indices. Las Vegas Sands (NYSE: LVS) stock is down by ~26% since early February, while its rival MGM Resorts (NYSE: MGM) has declined 53% over the same period. The huge exposure of MGM Resorts to the low-growth region of Las Vegas has been a deterrent in this recessionary environment. In 2019, MGM Resorts generated nearly 50% of its total revenues from Las Vegas while Sands’ exposure stood at less than 10%.

Mandalay Bay Casino Hosts

Las Vegas Sands To Outperform MGM Resorts Leveraged By Its Leadership In Macau

Mandalay Bay Casino Shooting

- With the coronavirus pandemic triggering lockdowns in all major economies across the world, the current difference in stock declines has less to do with geographic exposure and more with the future growth prospects.

- Las Vegas Sands commands a 45% share of the mass baccarat market in Macau whereas MGM Resorts’ share stands at around 10%. (Note:Macau’s Mass Baccarat business has been growing at an annual rate of 20% despite the overall contraction of Macau Gaming Market.)

- Moreover, MGM’s sale of Bellagio, Circus Circus, MGM Grand, and Mandalay Bay has unlocked capital for the prospective integrated resort in Japan but, the current downturn increases risks associated with the new project.

- The long-term debt on MGM Resorts and Las Vegas Sands’ balance sheet of $15 billion and $12 billion, respectively, is fairly comparable.

- MGM’s high exposure to the U.S. casino market is a key obstacle in generating higher returns. Also, its long-term debt, which now stands higher than the stock’s market capitalization, has not been eased due to the lease-back transactions with various REITs.

- In 2019, Las Vegas Sands generated $3 billion of operating cash flow while MGM Resorts generated $1.8 billion. While both reported around $13 billion in total revenues.

- Overall, we expect Las Vegas Sands’ to continue to outperform MGM Resorts majorly due to its strong presence in Macau and higher operating cash flow.

Our dashboardforecasting US COVID-19 cases with cross-country comparisons analyzes expected recovery time-frames and possible spread of the virus.

Further, our dashboard -28% Coronavirus crash vs. 4 Historic crashes builds a complete macro picture and complements our analyses of the coronavirus outbreak’s impact.

See all Trefis Price Estimates and Download Trefis Data here

Mandalay Bay Casino Stock

What’s behind Trefis? See How It’s Powering New Collaboration and What-Ifs ForCFOs and Finance Teams Product, R&D, and Marketing Teams